Helping you…

TutorBird is the #1 tutor management software for private tutors, tutoring centers, and test prep centers. Student management, flexible scheduling, online payments, and more – all in one place!

Designed for tutors of all kinds

Private

Tutoring

Tutoring

Centers

Travelling

Tutors

Online

Tutoring

Start your 30-DAY FREE trial now

No credit card required

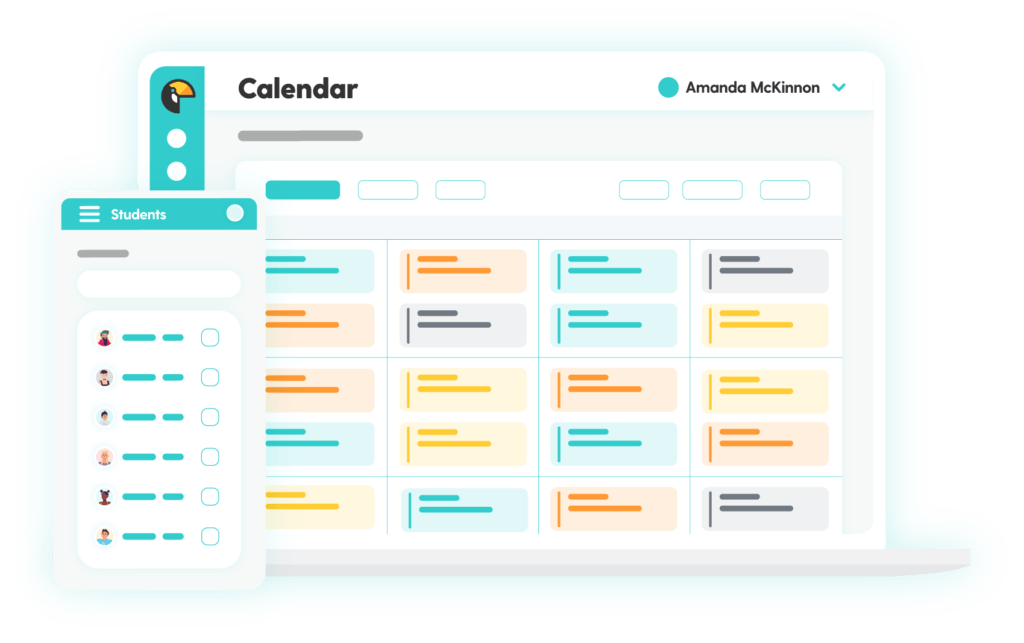

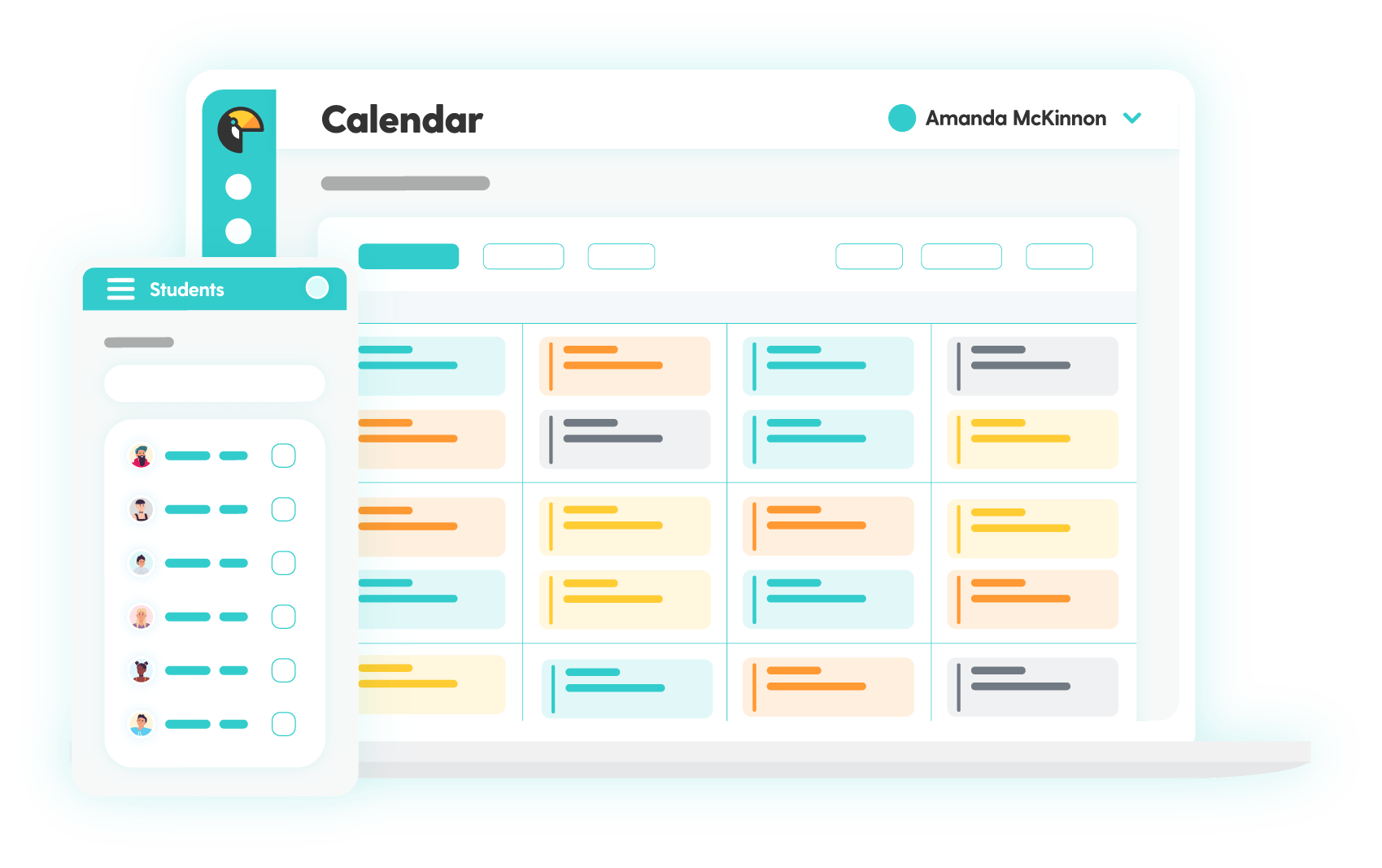

Organize your lessons

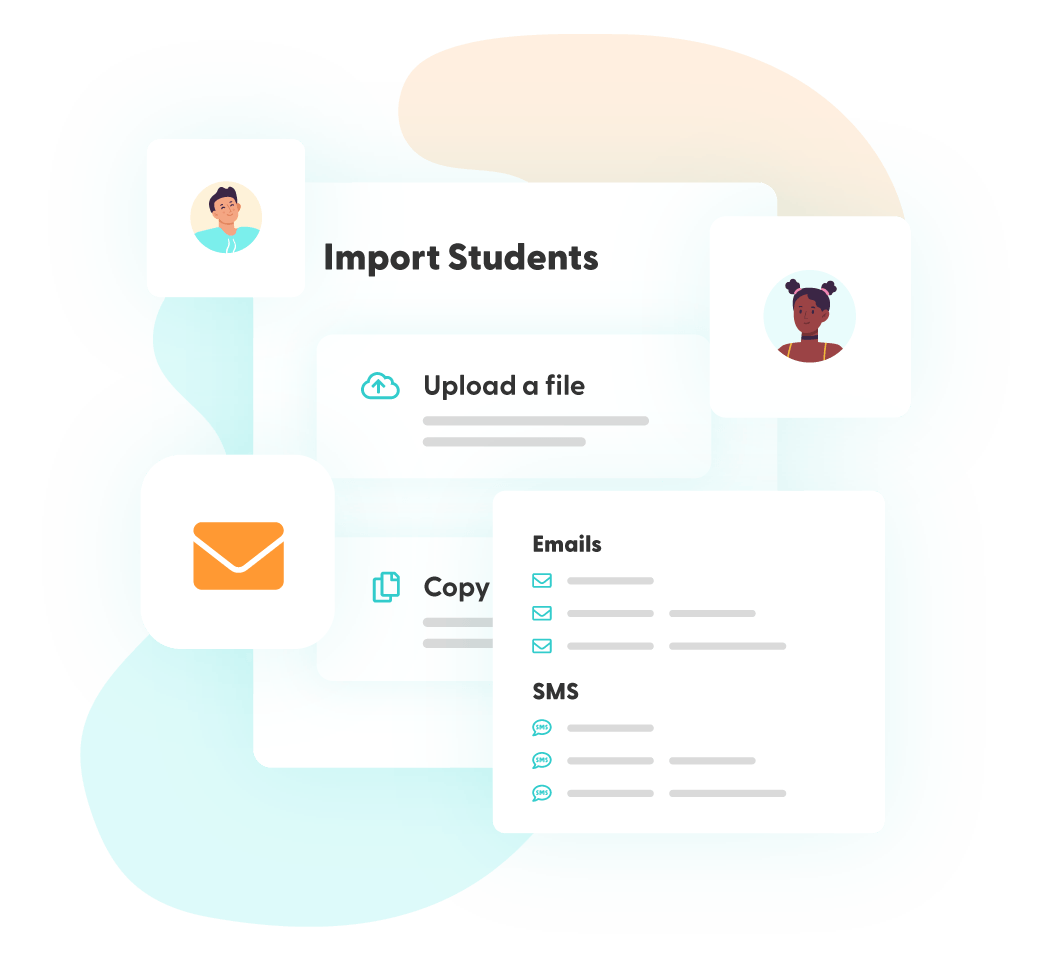

Manage your students

Customer Reviews

240 Reviews

5 Star

81%

4 Star

17%

3 Star

1%

2 Star

0%

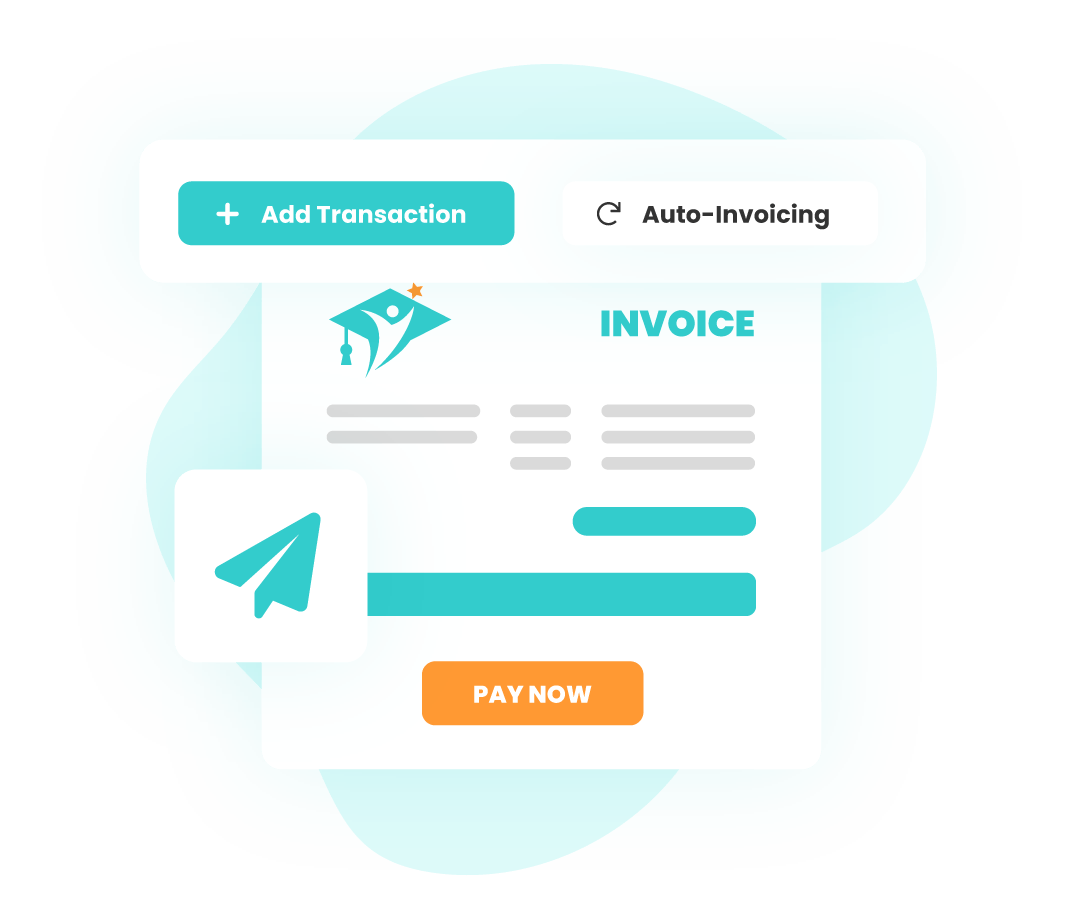

Get paid on time

Invite families to the Student Portal

Start your 30-DAY FREE trial now

No credit card required